1. Pendahuluan: Onboarding Cepat = Fintech Tumbuh Lebih Cepat Di industri fintech yang kompetitif, kecepatan onboarding menjadi salah satu kunci utama pertumbuhan. Namun sayangnya, banyak platform fintech masih bergantung pada proses verifikasi manual yang memakan waktu dan rentan kesalahan. Akibatnya,…

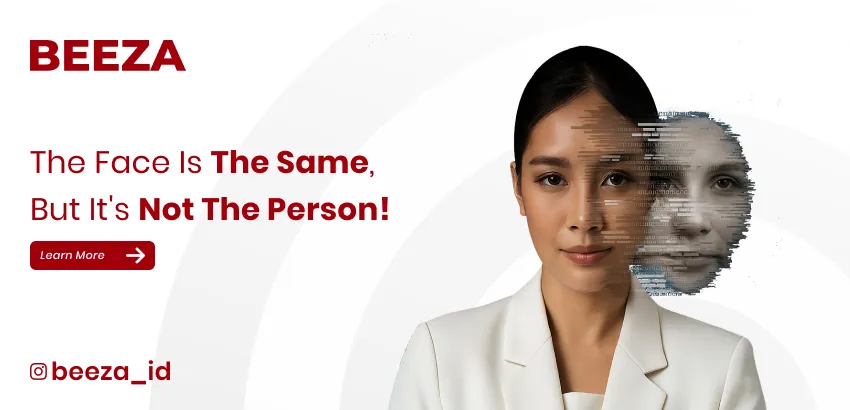

Same Face, But Not the Same Person! As Deepfakes Get Smarter, Businesses Need eKYC That’s Fast and Secure

1. Introduction: Data is an Asset, Not a Burden Recent studies show that 60% of SMEs still overlook the importance of data protection. Many businesses still view cybersecurity as a “cost” rather than an investment. In today’s digital-first environment, data…

DPR (Data-Proof Reality): The Truth Is, Without 2FA, Your Data Is Still at Risk

1. Introduction: What is DPR (Data-Proof Reality)? In the digital world, DPR doesn’t refer to parliament—it means Data-Proof Reality, the cold hard truth about your digital security.It’s the understanding that your data is never truly safe if your system still…

Did You Know? The Human Face Has 80+ Unique Verification Points for Face Match!

In today’s fast-paced digital world, the risk of identity theft, face match and personal data misuse is on the rise. Many internet users are unaware that casually uploading their ID photos or logging in without proper verification systems can open…

The Work You Do Today Will Be a Blessing Tomorrow – Start Digitalization Your Work Now

When was the last time you thought about how your work today could impact your future? Many people underestimate the small steps they take today. In fact, these small steps – when done with the right tools and mindset –…

Beware of Fake ID Cards – Protect Your Business from Fraud

Today, identity fraud has become more sophisticated and can target anyone, including businesses of all sizes. One of the most common tricks is using fake ID cards to open accounts, apply for loans, or commit fraud. If your business relies…

Ever Been Asked to Blink During a Selfie? Here’s What Liveness Detection Really Is

Have you ever wondered why some apps or online services ask you to blink, turn your head, or smile when taking a selfie for verification? That’s not just for fun – it’s called liveness detection, a vital security feature in…

4 Types of Digital Identity Verification You Should Know

In the digital era, verifying someone’s identity is no longer just about looking at an ID card or signing papers in person. Today, many industries rely on digital identity verification to ensure that the person they’re dealing with is really…

When Is the Best Time to Start Using Beeza?

Many businesses still think digital solutions are only for large corporations with big budgets. In reality, digital transformation is now a necessity for companies of all sizes — including startups, SMEs, and even individual professionals. One question often asked is:…

Ever Heard of Data Shadowing? Here’s Why You Should Care

In this digital age, data is everywhere. Every time you sign up for a new app, shop online, or log in with social media, you leave a trail — a trail that can grow into something called Data Shadowing. So,…